2022 a quiet time for M&As

Photo: VnEconomy

Photo: VnEconomy

Sharing at the press conference to announce the "14th Vietnam M&A Forum (M&A Vietnam Forum) 2022" organized by Investment Newspaper on November 3, Dr. Nguyen Cong Ai, Deputy General Director The director of KPMG Vietnam said that the M&A market this year decreased sharply in both the number of deals and the scale compared to 2021.

THE MARKET INTO LOWER

A representative of KPMG said that the economy in 2021 was in crisis, but the M&A market was very active. However, entering 2022, the economy changed from "excess money" to "lack of money", causing M&A activities to fall into silence.

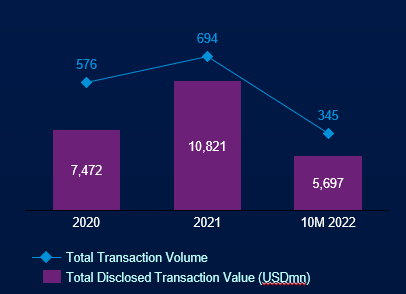

KPMG's statistics show that, if in 2021 the M&A market has 700 deals, in the first 10 months of 2022 there will only be 350 deals. Accordingly, the total value of M&A also decreased by 35.3% over the same period last year, reaching $5.7 billion.

With such a decrease along with the fact that a number of big deals have not been implemented as planned, KPMG forecasts that the situation in the remaining 2 months of 2022 will not be too positive.

"In 2022, the M&A deal reached the highest value of about 500 million USD while no deal reached 1 billion USD," said Mr. Ai, adding that the M&A market is quiet but has not yet fallen into a "sleep" state. bronze".

Number of deals and M&A value from 2020 to October 2022. Source: KPMG.

Clear evidence, according to Dr. Nguyen Cong Ai, some industries and fields still attract many investments such as consumption (1.2 billion USD), real estate (nearly 1 billion USD), industry (800 million USD).

In particular, the energy industry is becoming the "hottest" in 2022 in terms of value growth, reaching nearly $ 600 million, an increase of about 6 times compared to the whole year of 2021.

“We forecast that energy will be a hot M&A sector in the near future. Currently, our unit is receiving a lot of requests from foreign investors interested in solar power, wind power and hydroelectricity", Mr. Ai revealed.

MANY BUSINESSES RECRUIT, OPPORTUNITIES “DOWN MONEY” INCREASE

Forecasting the picture of M&A in the near future, Mr. Phan Duc Hieu, Standing Member of the Economic Committee of the National Assembly, said that current M&A activities tend to shift from "opportunity" to "strategy". that is, towards long-term value rather than short-term opportunity.

"The quality of M&A is changing, so it's not enough based on the size of the reduction to say the market is not good," said Mr. Hieu.

However, Mr. Phan Duc Hieu acknowledged that the risks and fluctuations of the market are causing buyers and sellers in the market to "hesit". However, the expert believes that the market will be activated again in the next 1-2 years when the economy's growth stabilizes again.

Sharing the same view, according to Mr. Bui Ngoc Anh, a representative of VLAF Law Firm, in the last 2-3 years, the legal appraisal process for M&A activities has taken longer than usual. Both the buyer and the seller must spend more time and money to learn and evaluate before deciding to "close the deal".

"But the opportunity for investors to "down the money" is great when the supply is increasing and after the down period, the market will go up", Mr. Ngoc Anh forecast.

Even for the real estate sector, Ms. Vu Thi Lan, Manager of the Valuation and Consulting Department, Cushman & Wakefeld (Vietnam) Co., Ltd., also expressed confidence in the recovery in the coming time. .

“The move to tighten the market by the state management agency as recently is to step by step purify the market. Despite the immediate difficulties, real estate is cyclical, after the hot fever period, it must slow down. At every stage, there are challenges, but there are also opportunities,” said Ms. Lan.

From the perspective of Dr. Nguyen Cong Ai, the M&A market in the period of 2023-2024 will be relatively quiet. However, this is also an opportunity for investors with available cash to buy attractive projects.

“The market going forward may be a buyer's market, not a seller's market. In particular, foreign investors will contribute more because domestic money sources are limited when interest rates rise and liquidity becomes less, forcing businesses to restructure, sell assets, and call for investment. due to financial pressure", KPMG representative forecast.

HOANHAP.VN

HOANHAP.VN